As borrowing costs rise and the US economic growth becomes less certain by the day, commercial real estate investors and consumers alike are searching for reliable signals of market directionality.

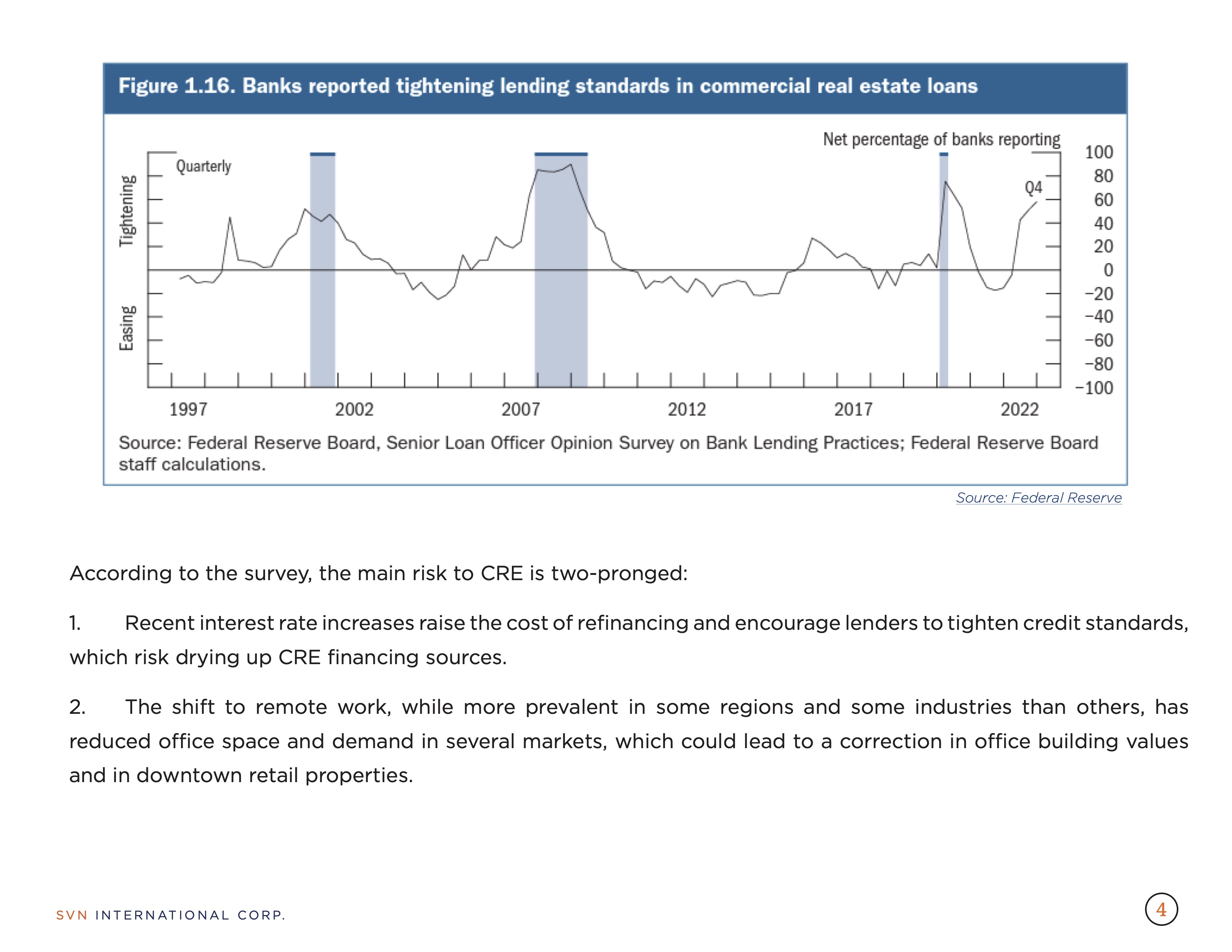

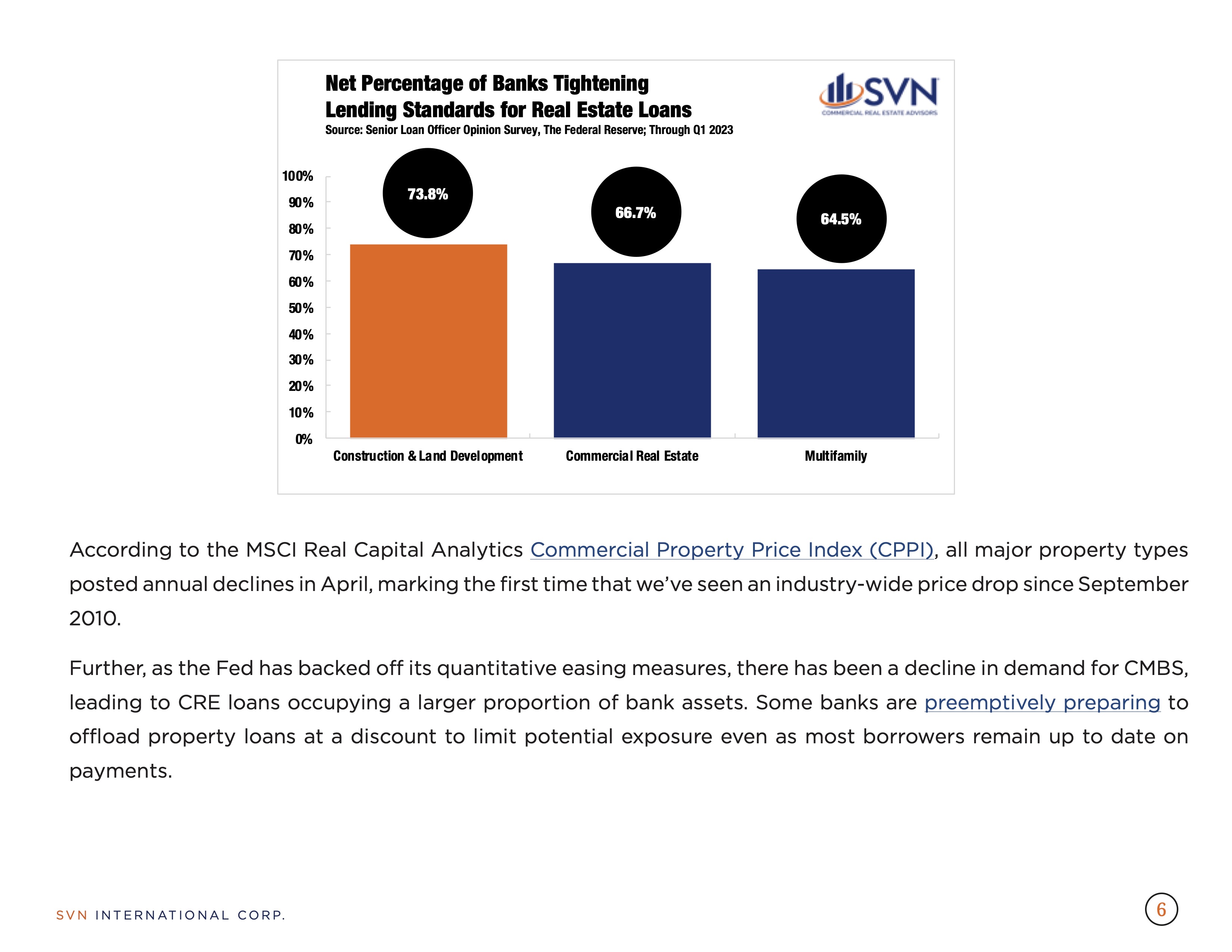

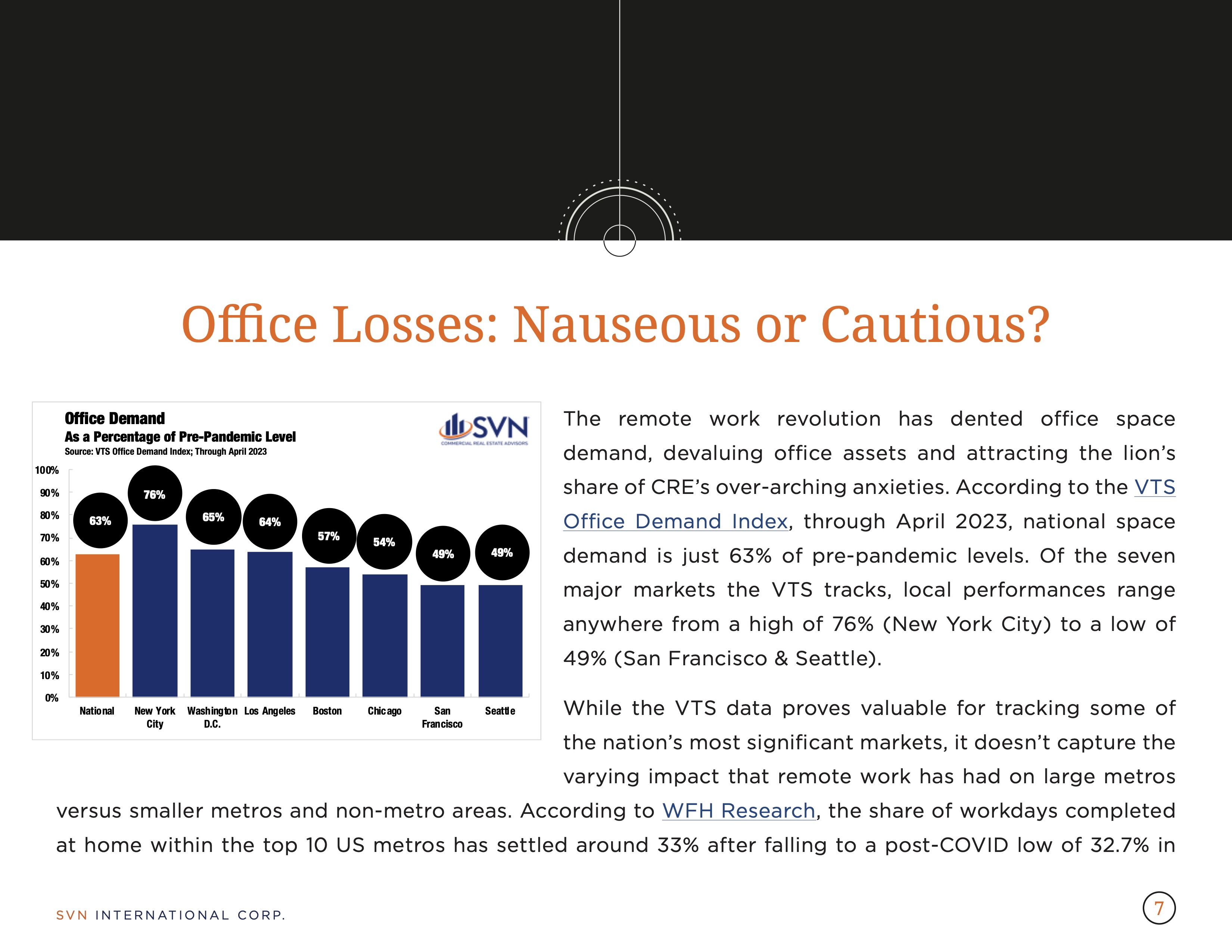

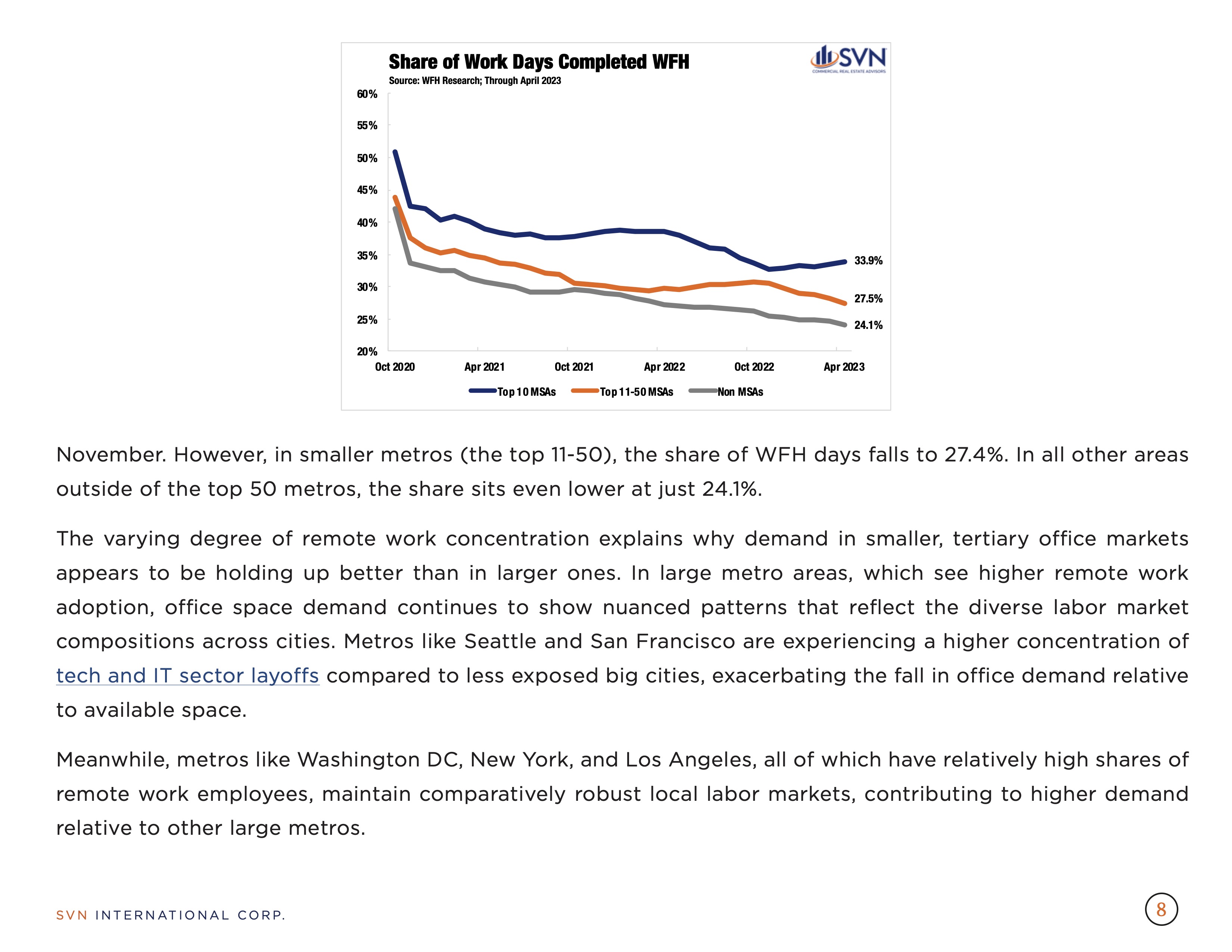

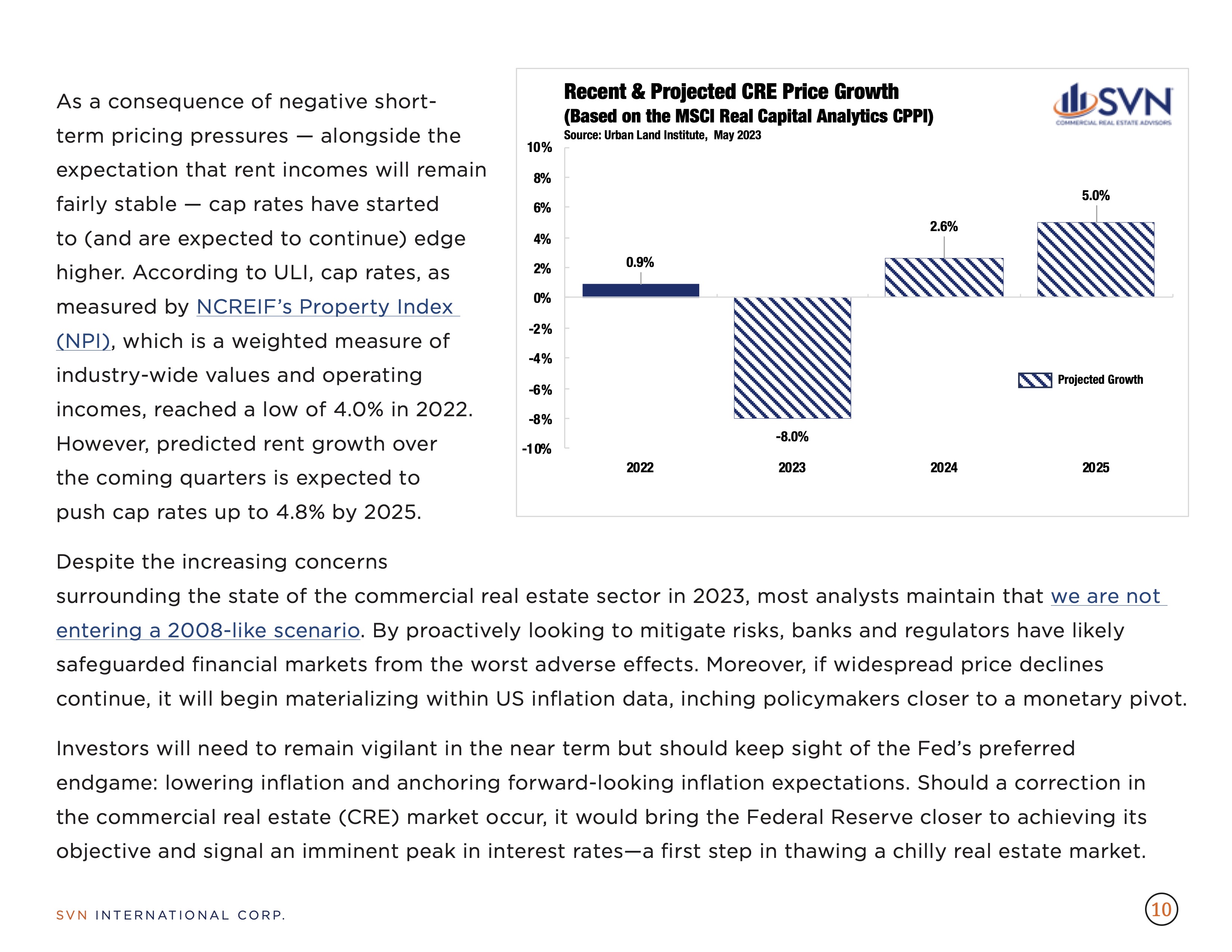

In recent months, banking system turmoil, which saw three mid-sized regional banks fail (including two of the largest failures in US history), became a flashing-red signal for market watchers. In this piece, the SVN Research Team looks at today’s most pressing risks to make the case that while CRE may grapple with distress, the brunt of pain will likely be contained to a handful of major markets and shielded by long-term fundamentals.