October 28, 2024

Durham-Chapel Hill MSA

Industrial Market Report - Q3 2024

By Carey Greene, Senior Vice President

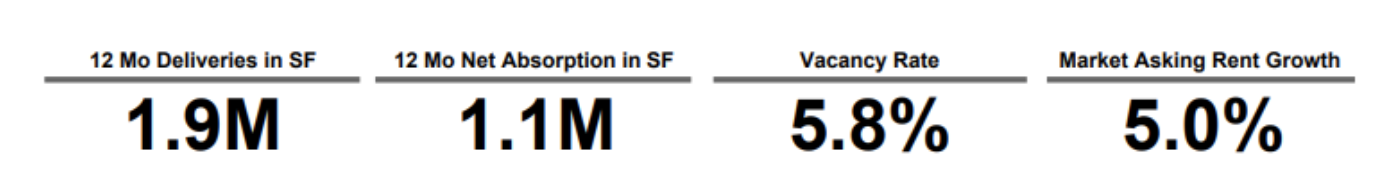

The industrial real estate landscape in the Greater Durham market continues to demonstrate its resilience and adaptability, even with some “decelerating” trends. Rent growth has fallen and vacancies have risen over the last 12 months, but much of this is largely due to the delivery of new projects, with more deliveries on the way. A snapshot of the greater Durham market and a summary of key trends follows.

Substantial Construction Affects Vacancy Rate

- The dynamic interplay of supply and demand has resulted in some notable shifts. Construction activity remains strong, with 2.6 million SF of industrial space currently under construction, representing a 4.9% increase in the market's inventory. This substantial construction pipeline, while reflecting confidence in the market’s long-term growth prospects, has led to a rise in vacancies, reaching 5.8% in Q3. This figure, slightly above the market's historical average, is indicative of a market adjusting to a new wave of supply.

Rent Growth: Deceleration Doesn't Mean Decline

- Annual rent growth in the Greater Durham industrial market continues to decelerate. Industrial rents have grown 5.0% over the past year. That level is well below the market's recent peak annual growth of about 10.5% in 2022 and slightly below the market's 10-year annual average growth of 6.2%. However, it remains slightly above the current U.S. rate of 3.0% which has also decelerated sharply over the past two years.

- Within the broader market, flex and logistics properties have experienced the most significant rent increases, reflecting a national trend driven by the sustained demand for distribution and e-commerce facilities. Flex properties in the market currently command an average rent of $20.00/SF, the highest among all property types, primarily due to the presence of specialized biotech-oriented spaces. Logistics properties, essential for the thriving e-commerce sector, rent for an average of $9.00/SF.

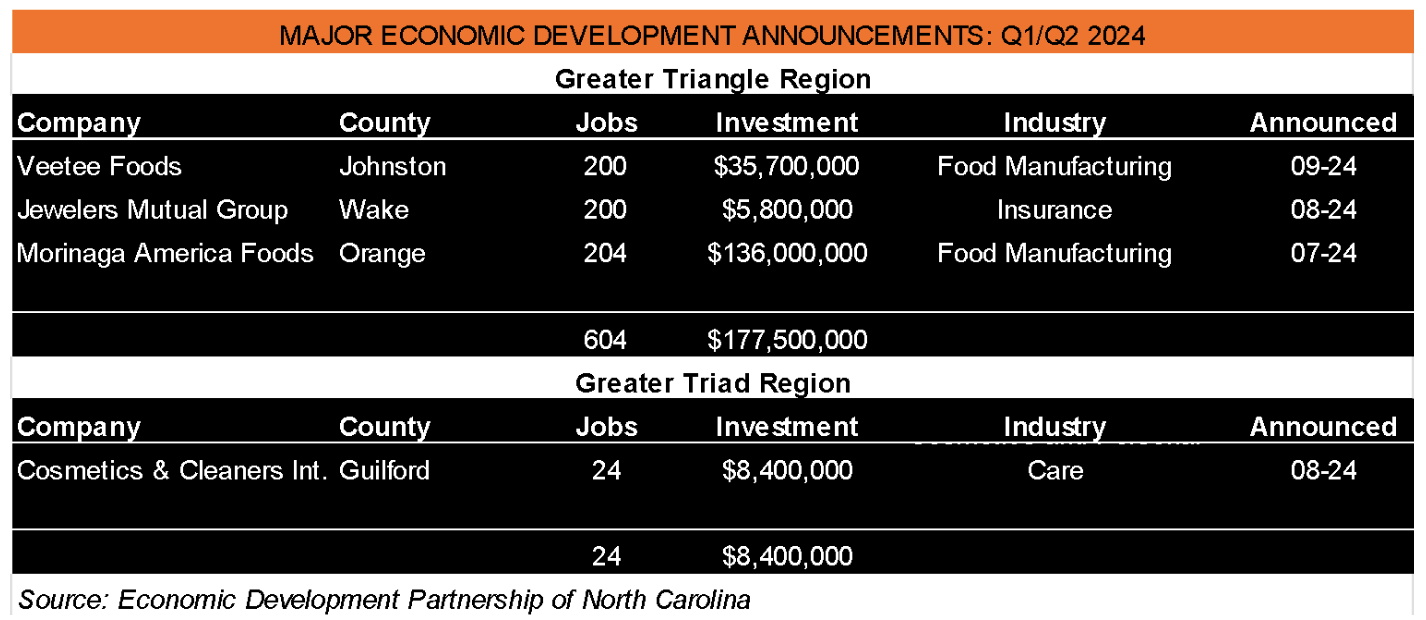

Major Economic Development Announcements

- Major economic development announcements in the Durham-Chapel Hill area, and in the Triangle and Triad regions in general, were limited during the 3rd Quarter. In the combined Raleigh-Cary and Durham-Chapel Hill MSAs (the Triangle), a total of 604 jobs and $177.5MM of major projects were announced. In the Triad, a total of just 24 jobs and $8.8MM were announced. Despite the lower numbers, the pipeline remains robust.

- The largest, both in terms of new jobs and total investment, was Morinaga America Foods’ 204-job, $136MM announcement of its expansion in Orange County. The Japanese company, which is well known for its HI-CHEW candies, established its presence in Mebane in 2013 where it built its first manufacturing facility outside of Asia. According to the Economic Development Partnership of North Carolina, over the last 10 years (2014-2023), Japan has announced 9,220 jobs and $17.58 billion in investment in North Carolina, accounting for nearly half of all foreign direct investment (FDI) and the State’s largest source of FDI. Japan is one of the nation’s largest trading partners and home to 225 companies with large presences in North Carolina.

No Purchase Opportunities for Users

- Continuing a trend that we have noted in this newsletter before, purchase opportunities for industrial users in the Greater Durham market remain nearly non-existent. In the 3rd quarter, an owner occupant looking to purchase industrial property in the market would have had to go to Person County to select from two relatively obsolete buildings. There were no properties available for sale in Durham or Orange Counties where most of the population lives and where transportation networks better serve the region.

Insurance Rates Continue Their Historic Climb

- A report from the insurance brokerage firm Marsh McLennan Agency said that commercial property insurance rates have seen year-over-year increases across 24 consecutive quarters and that rate increases averaged 11% at the end of 2023. "High-magnitude catastrophic losses, the enduring challenges of the pandemic on the supply chain, fluctuations in the employment market, and rising inflation have banded together to create a perfect storm that threatens the sustainability of every property portfolio," they wrote.

Looking Ahead: A Balanced Outlook for Durham's Industrial Properties

Despite the ongoing economic uncertainty and the anticipated rise in vacancy rates due to the robust construction pipeline, Greater Durham’s industrial market is poised to maintain its positive momentum. The sustained demand, driven by a diverse tenant base and a growing population, coupled with a slowdown in rent growth, is expected to create a balanced market environment, offering attractive opportunities for both investors and users. Major economic development projects continue to fill the State’s pipeline, even if announcements and starts have slowed down.

Sources: CoStar, GlobeSt.com, Economic Development Partnership of North Carolina, SVN | Real Estate Associates

MAJOR TAKEAWAYS FROM Q3 (CAREY'S $0.02): Construction projects already underway will make their way into the industrial supply over the next 18 months. This will likely continue the trend of slowing the growth of, but not decreasing, rental rates for industrial property. However, there is some evidence to suggest that a flight to quality for industrial users will negatively impact rents for older industrial properties. This could eventually affect valuations for this pool of properties, often owned by users. It may also lead investors to sell more of these properties into that pool. This may help alleviate some of the pent-up demand from companies looking to own and use industrial real estate in the region.

Sticker shock from insurance rate hikes is going to continue in the wake of major storms in the southeast, and in particular Hurricane Helene’s impact on Western North Carolina. Landlords may be able to pass most or all of these increases through to tenants depending on the structure of their leases, but, eventually, these costs may eat into base rents and affect valuations.

Economic development was less robust for the Triangle last quarter. Major projects lead to more suppliers and other commerce in the area, which also helps drive property values. With a robust pipeline, we expect more good news even if some of the mega projects such as Apple and VinFast have been delayed.