August 6, 2024

Durham-Chapel Hill MSA Q2 Industrial Market Report

By Carey Greene, Senior Vice President

For buyers of small to medium sized industrial properties in the greater Durham-Chapel Hill MSA (Durham), limited opportunities to purchase listed properties remains a challenge. However, those looking to lease large footprints have many more opportunities in the area, as well as in the greater Triangle and Triad areas, as large industrial project developers have delivered new spaces or have buildings under construction. A snapshot of the greater Durham market and a summary of key trends follows.

- Going into 24Q3, a wave of recent deliveries has outpaced demand, causing vacancies to rise in the Durham industrial market. Durham's robust construction pipeline means that vacancies will continue to rise in the market over the next few quarters.

- Construction starts have been moderate the last couple of quarters, and Durham's construction pipeline has declined slightly, but remains robust, with 2.2 million SF of space under construction in the market.

- While demand in Durham has been average over the past year, it has not kept pace with new supply. Developers have delivered 2.0 million SF of new industrial space over the past year, causing vacancies to rise to 6.3%.

- Annual rent growth in Durham continues to decelerate. Industrial rents in Durham have grown 6.0% over the past year, well below the market's recent peak annual growth of about 11% in 2022. Even with the deceleration, Durham's current annual rent growth remains in line with the market's 10-year annual average growth of 6.4% and above the current U.S. rate of 3.8%.

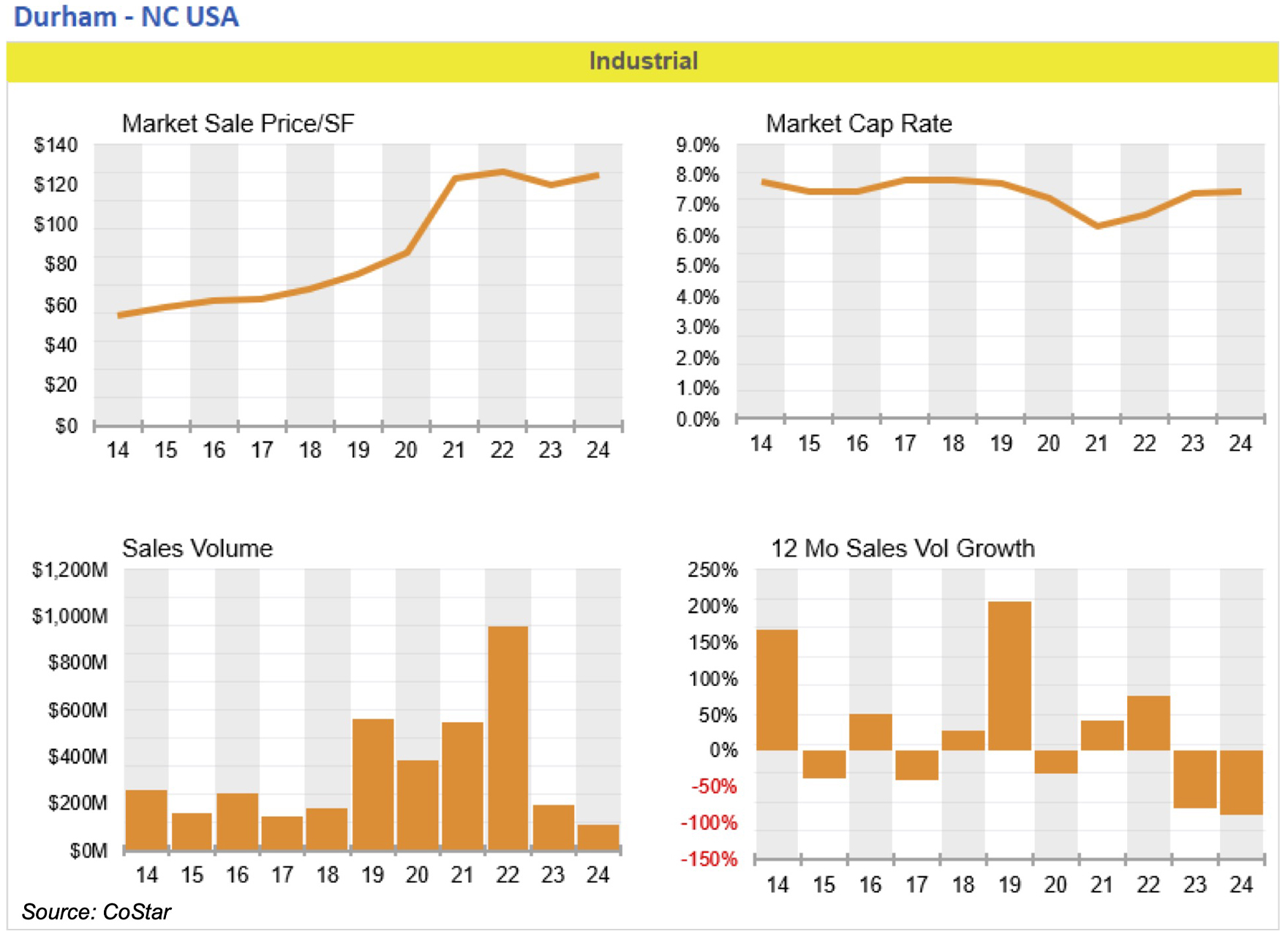

- Like in many markets around the country, industrial sales volume in Durham has been far below normal over the past year. Going into 24Q3, transaction volume in Durham has totaled just $110 million over the past 12 months, compared to the market's historical annual average of $355 million. Quarterly sales volumes had been below $45 million for four consecutive quarters before 24Q2.

- High interest rates have kept sales volume low and most recent deals have been smaller, averaging about $3 million per transaction. In addition, a higher percentage of buyers have been users.

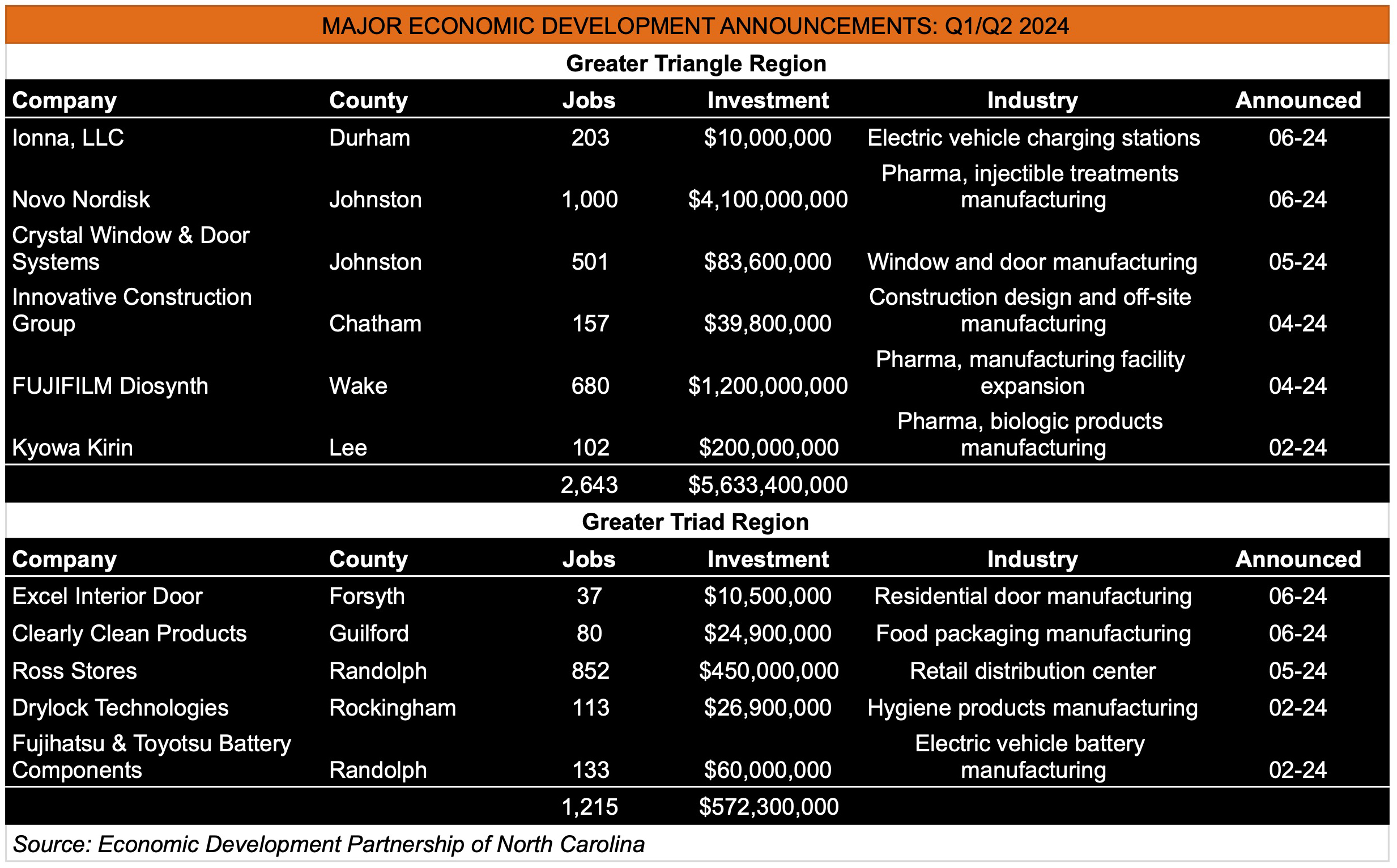

- Looking ahead, sales volume will likely remain low in the near term because of broader economic and financial conditions, including high interest rates. However, Durham retains long-term drivers, especially for distribution and life science tenants. Durham's rise as a technology hub has also fueled much of the area's population growth, in turn capturing the attention of out-of-state and institutional investors. Finally, the region's emergence as a potential hub for electric vehicle and battery manufacturing may provide a new source of demand for the market's industrial facilities, especially in outlying areas such as Chatham County.

- Economic Development in the Triangle and Triad regions continues to fuel growth in the Durham-Chapel Hill MSA. While some announcements have been put on hold, such as Apple delaying its new campus in Research Triangle Park and VinFast slowing down its development of its electric vehicle assembly plant in Chatham County, several significant announcements still took place. Economic development is a key driver of industrial sector growth.

While some industrial market indicators have been negative over the past 3-12 months, most have little cause for concern. The Durham-Chapel Hill MSA continues to grow both in population and by way of economic development, which outpace national averages, driving additional industrial demand. This has resulted in robust need for e-commerce and other distribution operations, particularly toward the west side of the market, along interstates 40 and 85. The Triangle's large and highly educated workforce has also attracted a wide variety of life science, pharmaceutical, and biotechnology companies.