January 27, 2025

Durham-Chapel Hill MSA Industrial

Market Report - Q4 2024

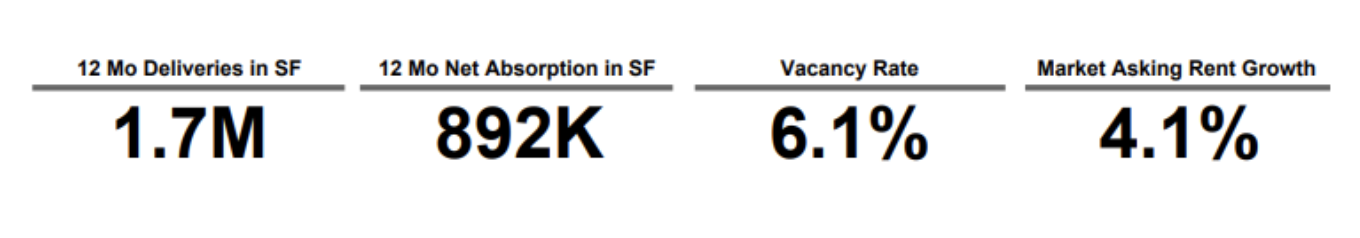

The industrial real estate landscape in the Durham-Chapel Hill MSA continues to demonstrate its resilience and adaptability, even with some “decelerating” trends. Rent growth has fallen and vacancies have risen over the last 12 months, but much of this is largely due to the delivery of new projects, with more deliveries on the way. A snapshot of the greater Durham market and a summary of key trends follows.

Construction, Absorption and Vacancy

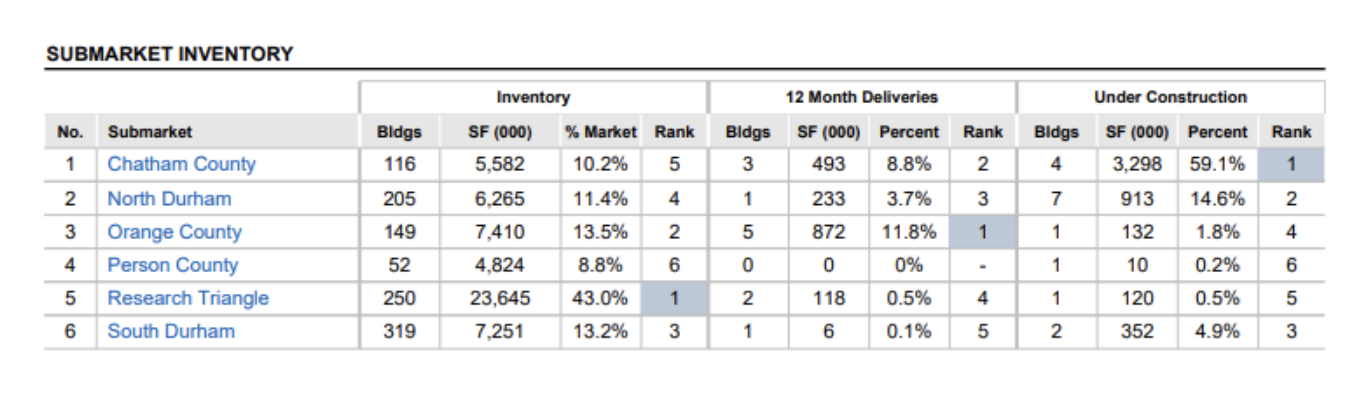

- We saw industrial vacancies in Q3 at 5.8% trend up to 6.1% in Q4 as new projects delivered and less space was absorbed. Chatham County has the most space currently under construction, but most of this (about 3MM SF) is consumed by two owner-user plants – Wolfspeed’s and VinFast’s (now delayed) delivery of new manufacturing facilities. North Durham, which previously had virtually no Class A industrial space, continues to see construction, delivery and lease up. Its largest development underway is the Welcome Venture Park, which is nearing completion of its first phase of construction.

Rents Grow, but More Slowly

Industrial rent growth in Greater Durham continues to cool down as the market's vacancy rates have crept up. Asking rents in Durham increased 4.1% over the past 12 months, compared to 8.9% annual rent growth a year ago at this time and 10.6% rent growth in 2022. Even with the deceleration, rent growth in Greater Durham remains higher than the national average of 2.1%, which has also decelerated sharply over the past two years.

Submarkets Vary Tremendously

Among the Greater Durham submarkets, industrial rents are highest in South Durham and the Research Triangle submarket, at over $14/SF. This includes all types of industrial properties such as flex, warehouse and specialized industrial. Of note, those submarkets have a larger amount of space used for research, development, and lab work. The most affordable submarkets are outlying areas such as Person County and Chatham County, where rents average less than $6/SF.

From my Recent LinkedIn Post – Nearshoring and Onshoring

I nerded out again recently and read the full Penske Logistics’ 2025 Third-Party Logistics Study, which surveyed hundreds of global shippers and 3PL companies. There were lots of interesting nuggets of information. Here’s some on nearshoring, or bringing business operations such as manufacturing and sourcing closer to home. 76% of shippers and 71% of 3PL companies say they are considering adjusting sources of supply to be more local/domestic. Of those surveyed, the top factors driving them are 1) Supply Chain Vulnerability (25%), 2) Increased Supply Chain Resilience (20%) and 3) Customer Service Levels (14%). To boil this down, the top goals are to lower risk in a world that has recently seen more geopolitical instability, and to get goods to consumers faster, as speed of delivery becomes more ingrained as an expectation.

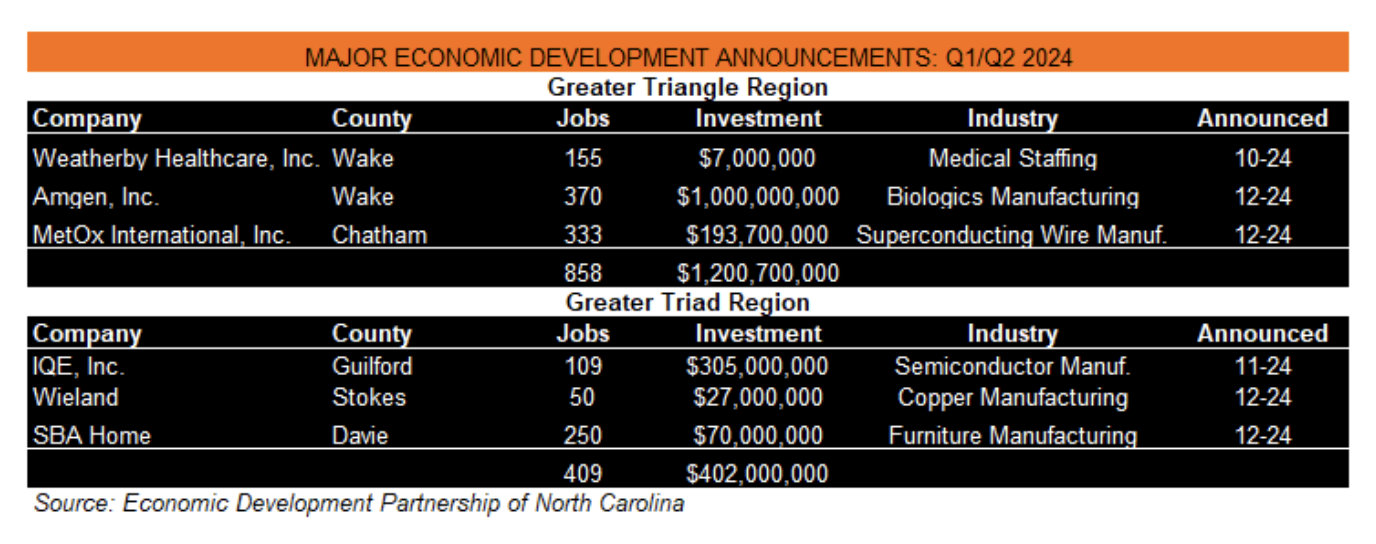

Onshoring, the practice of moving operations and sourcing back home, has the benefit of bringing direct investment and jobs. As we’ve already seen with some of our top economic development announcements over the past few years, North Carolina stands to benefit tremendously from this ongoing movement. In addition to direct foreign investment, US-based companies continue to select the State for expansion. Speaking of economic development…

Major Economic Development Announcements

- Major economic development announcements in the Durham-Chapel Hill area, and in the Triangle and Triad regions in general, were more robust in the 4th Quarter compared to the 3rd Quarter. In the combined Raleigh-Cary and Durham-Chapel Hill MSAs (the Triangle), a total of 858 jobs and $1.21B of major projects were announced. In the Triad, a total of 409 jobs and $402MM were announced. This is a huge increase over Q3, when we saw just 628 jobs and $186MM of announced new investments combined!

- By far the largest announcement of the quarter was Amgen, Inc’s decision to invest $1B in Wake County to expand its biologics manufacturing operations in Holly Springs. The average annual salary for the new positions will be over $91K.

Still No Purchase Opportunities for Users – Okay There Was One!

- Continuing a trend that we have noted in this newsletter before, purchase opportunities for industrial users in the Greater Durham market remain nearly non-existent. After a 3rd Quarter that saw zero purchase opportunities in either Durham or Orange Counties, Q4 saw one property over 5,000 SF, a 43 year old metal building with low ceilings, go on the market. It went under contract almost immediately. That should tell you something about supply and demand for industrial properties in the Greater Durham market! It had an impressive asking price of $188/SF, and we look forward to reporting that comp next quarter after its expected close.

MAJOR TAKEAWAYS FROM Q3 (CAREY'S $0.02)

It seems as if every week I get a new email blast advertising a new “big box” industrial project for lease. I’ll be honest, I do enjoy a big industrial park, and in a world where supply chains are vulnerable and customers want their products to drop onto their doorsteps the day they order them, we will continue to need development of these new buildings. However, for my many clients who want to own 20,000-50,000 SF buildings, few opportunities exist in our market. Our clients are beginning to deal with this by looking for product in markets further out, such as Granville and Alamance Counties, or considering ground up construction themselves or through a developer. Some have thrown in the towel and have decided to lease instead. Whoever has the secret recipe for how to profitably develop and sell properties of this size can rest assured that the pool of buyers would run deep. Until then, the big box industrial deliveries we have seen in Q4 have outpaced lease demand and have caused rents to cool a bit. I have little doubt though that these spaces will fill.

Economic development had a great quarter. Thank you to all of the economic development folks who get little attention but are the glue that help these projects come together. Major projects create jobs, additional tax base for schools, parks, police and other local investments. They also lead to more suppliers, more service needs and other commerce in the area and help drive property values. With companies expecting more nearshoring and onshoring and sourcing more goods from close by, I can only expect the Triangle, Triad and North Carolina as a whole to continue to benefit.

Sources: CoStar, GlobeSt.com, Economic Development Partnership of North Carolina, SVN | Real Estate Associates