October 25, 2024

Alamance County Industrial

Market Update - Q3 2024

By Brian Alonso, Advisor

The industrial real estate landscape in the Triangle and Triad markets continues to demonstrate its resilience and adaptability, even with some “decelerating” trends. In Alamance County, rent growth has fallen and vacancy has risen over the last 12 months, but much of this is largely due to the delivery of new projects, with more deliveries on the way. A snapshot of the greater Alamance County/Greater Burlington market and a summary of key trends follows.

Steady Demand Amidst Declining Absorption:

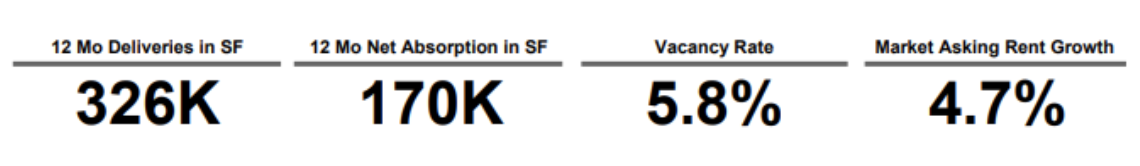

While the national industrial market is witnessing a decline in net absorption, Alamance County bucks the trend. The county recorded a positive net absorption of 170,000 square feet over the past year, demonstrating continued demand for industrial space despite national headwinds. This strong performance is further highlighted when compared to the national figure, which saw a decline of approximately 50%, down to 65.8 million square feet year-over-year.

The demand for space is particularly strong in newly constructed, high-quality facilities. The absorption of industrial space built between 2023 and 2024 in the US has reached 395 million square feet since Q1 2023. In contrast, properties constructed in the previous 22 years have experienced a negative net absorption of 17 million square feet. This trend is playing out in Alamance County as well, with newer facilities attracting a significant share of leasing activity.

Vacancy Rates Remain Stable:

While the national industrial vacancy rate continues to rise, Alamance County's rate remains stable at 5.8% - in line with the five-year average of 5.7%. This stability points to a healthy balance between supply and demand, suggesting that the county is well-positioned to absorb new deliveries without a significant impact on vacancy rates. This is further reinforced by the shrinking construction pipeline. The county has 430,000 square feet of industrial space currently under construction, a decrease from previous quarters. Nationally, the total square footage under construction has also decreased for six consecutive quarters, reaching its lowest level since Q3 2019. This decrease in new construction is likely to contribute to upward pressure on rents in the coming quarters.

Investor Confidence Persists:

Despite the national slowdown, Alamance County's industrial market continues to attract investor interest. Year-to-date, the county has seen $168 million in sales volume, a 16.1% decrease from last year but still representing 61 individual transactions. This continued investment activity highlights the long-term confidence in the county's industrial market.

Notable Projects on the Horizon:

Several notable industrial projects are in progress or have been recently announced in Alamance County, further boosting the positive outlook for the sector.

- Crow Holdings Industrial Development: This expansive project encompasses two adjacent buildings, 2120 and 2110 Senator Ralph Scott Parkway in Mebane, totaling approximately 404,450 square feet. With completion dates slated for November 2024 and September 2025 respectively, these developments signify a substantial investment in the region's industrial capacity.

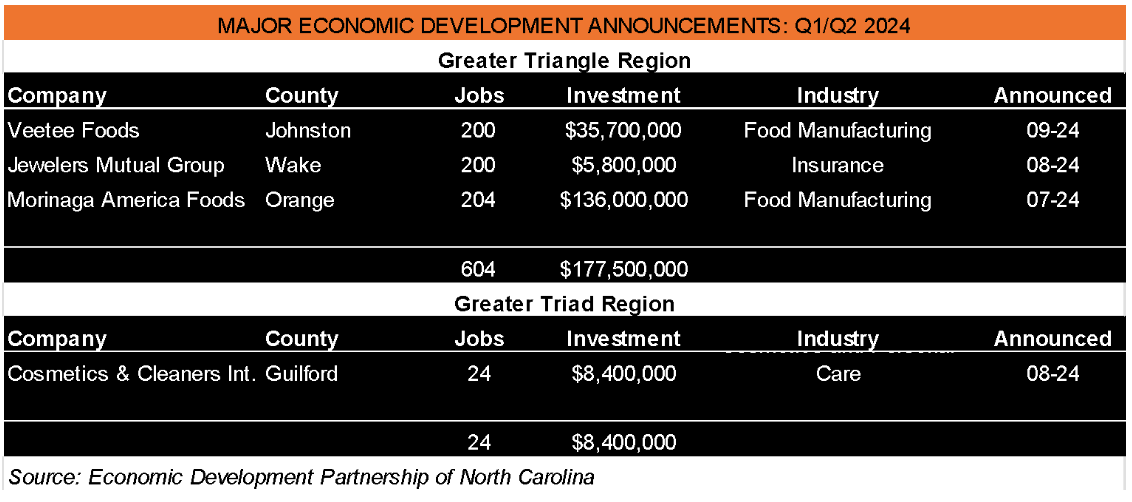

- Morinaga America Foods: The largest economic development accouncement, both in terms of new jobs and total investment, was Morinaga America Foods’ 204-job, $136MM announcement of its expansion in Orange County very close to Alamance County border. The Japanese company, which is well known for its HI-CHEW candies, established its presence in Mebane in 2013 where it built its first manufacturing facility outside of Asia. According to the Economic Development Partnership of North Carolina, over the last 10 years (2014-2023), Japan has announced 9,220 jobs and $17.58 billion in investment in North Carolina, accounting for nearly half of all foreign direct investment (FDI) in North Carolina, making it the state’s largest source of FDI. Japan is one of the nation’s largest trading partners and home to 225 companies with large presences in North Carolina.

These projects not only underscore the confidence in the industrial market in the region but also point to continued growth and development in the years to come.

Sustained Rent Growth Anticipated:

The stable vacancy rates and continued demand for industrial space are expected to drive rent growth in Alamance County. Market rents have increased by 4.7% year-over-year, showcasing the sector's ability to generate strong returns for property owners. With a dwindling construction pipeline and rising construction costs, further upward pressure on rents is anticipated. This makes Alamance County an attractive market for investors seeking long-term, stable returns.

A Bright Outlook for the Future:

The industrial market in Alamance County is demonstrating remarkable resilience in the face of national economic headwinds. With strong demand, stable vacancy rates, ongoing investor interest, and exciting new developments on the horizon, the sector appears poised for continued growth in the coming years. Property owners in the county can be optimistic about the long-term prospects for their industrial assets. The combination of local strength and emerging national trends suggests that Alamance County is well-positioned to capitalize on the evolving landscape of the industrial real estate sector.

Sources: CoStar, GlobeSt.com, Economic Development Partnership of North Carolina, SVN | Real Estate Associates