January 29, 2025

Alamance County Industrial

Market Report - Q4 2024

The industrial real estate landscape in the Alamance County/ Burlington MSA continues to demonstrate its resilience and adaptability, even with some decelerating trends. Rent growth rate has fallen and vacancies have risen over the last 12 months, but much of this is largely due to the delivery of new projects.

Construction, Absorption and Vacancy

- We saw industrial vacancies in Q3 at 5.5% trend up to 7.9% in Q4 as new projects were delivered and less space was absorbed. Over 400,000 sqft of space was delivered in the North Carolina Commerce Park in Mebane by Crow Holdings.

- Availability of industrial and flex buildings for sale and/or lease between 5,000 and 50,000 sqft in Alamance County continues to be extremely limited. Very little new product has been built, and demand is strong in this sector.

Not Quickly, but Rents Grow

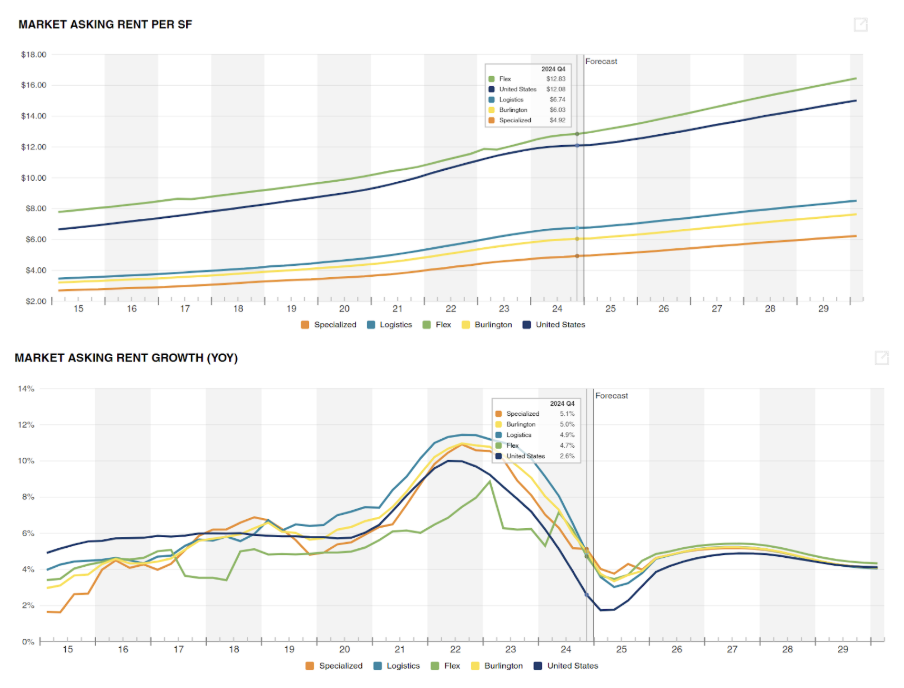

Industrial rent growth in Alamance County continues to cool down as the market's vacancy rates have crept up. Asking rents increased 5.0% over the past 12 months, compared to 9.1% annual rent growth a year ago at this time and 10.8% rent growth in 2022 Q4. Even with the deceleration, rent growth in Alamance County remains higher than the national average of 2.6%, which has also decelerated sharply over the past two years.

Source: CoStar

Source: CoStar

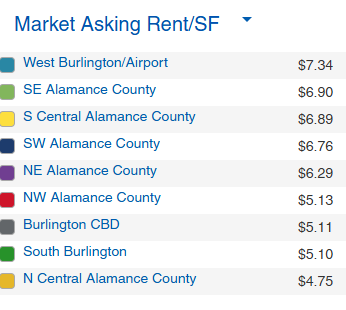

Submarkets Vary

Among the Alamance County submarkets, industrial rents are highest in West Burlington at $7.34/SF. This includes all types of industrial properties such as flex, warehouse and specialized industrial. The second highest is SE Alamance County at $6.90/SF. The most affordable is North Central Alamance County at $4.75 average asking rent per square foot. These numbers are still lower, but not far off, from Guilford County’s average asking rent of $7.01/sqft. They are more affordable than Durham County’s $11.39/sqft average industrial rents.

Source: CoStar

Source: CoStar

Nearshoring & Onshoring

Nearshoring and onshoring have become pivotal strategies for businesses in Alamance County, as companies seek to optimize their supply chains and strengthen local economic ties. Nearshoring, which involves relocating operations to neighboring countries or closer regions, has become appealing for companies in Alamance County aiming to reduce lead times and transportation costs while maintaining access to skilled labor. The county's proximity to major transportation hubs like the Research Triangle and its supportive infrastructure make it an ideal location for businesses seeking to work with suppliers or partners in nearby regions, such as Mexico or Central America. This trend has particularly benefited industries like textiles, advanced manufacturing, and logistics, which are prominent in the area.

Onshoring, or the relocation of operations back to the United States, has similarly gained momentum in Alamance County as businesses aim to bolster domestic production and reduce reliance on overseas manufacturing. This shift has been driven by factors such as rising international shipping costs, global supply chain disruptions, and a growing emphasis on supporting the local economy. The county's strong workforce development programs and partnerships with institutions like Alamance Community College further support onshoring efforts, helping to train and prepare workers for advanced roles in manufacturing and technology. Together, nearshoring and onshoring are shaping Alamance County into a competitive hub for businesses prioritizing resilience, sustainability, and proximity in their operational strategies.

Notable Economic Development Announcements

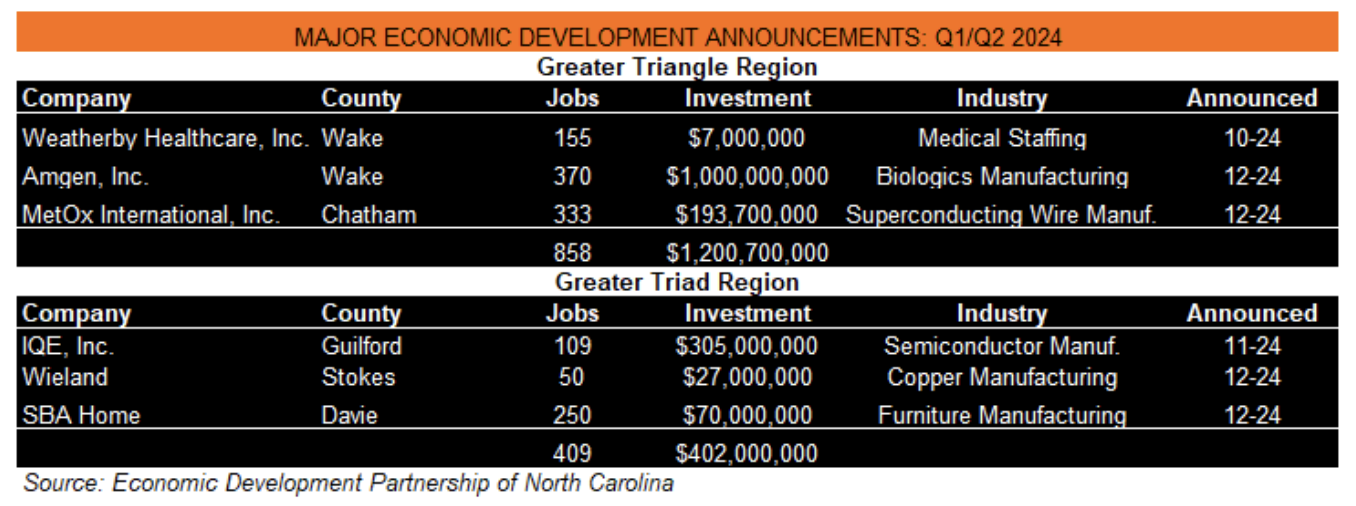

In the fourth quarter of 2024, Alamance County, North Carolina, witnessed significant economic development activities. In December 2024, the city of Burlington appointed a new director of economic development, signaling a renewed focus on attracting and managing business growth within the city.

Earlier in the year, in June 2024, Mebane's planning board reviewed rezoning requests for two substantial projects along Buckhorn Road, encompassing approximately 134 acres near Interstate 85/40. These developments included plans for a trucking and freight terminal, as well as two large warehouses, indicating a strategic move to enhance the county's logistics and distribution capabilities.

Some other notable economic developments in central North Carolina include –

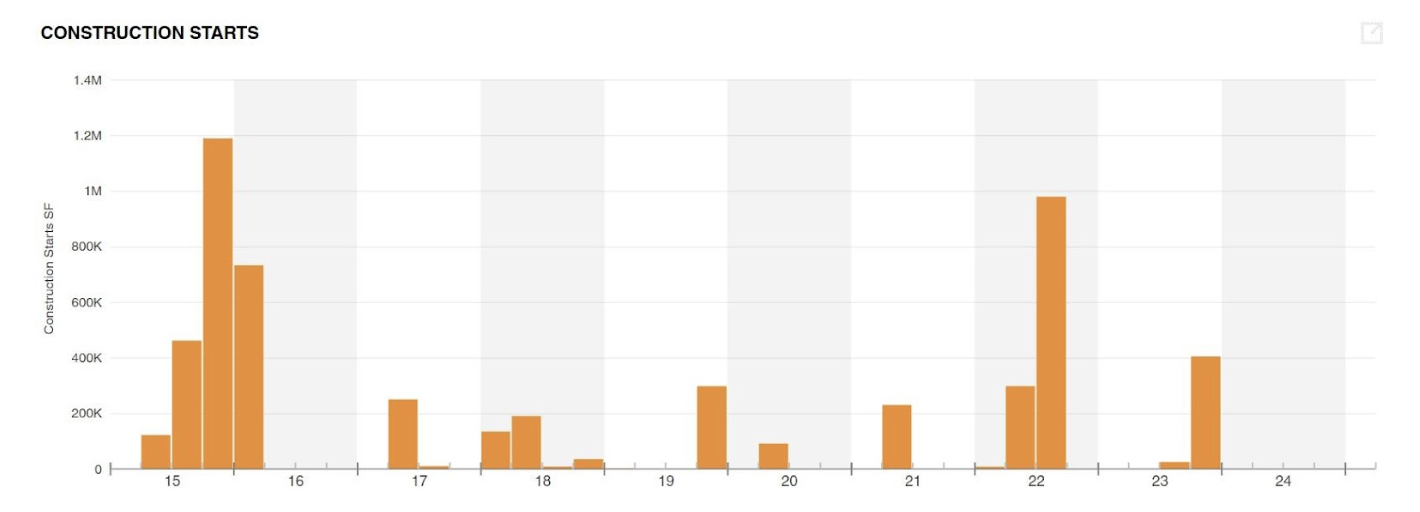

Quiet Quarter for Construction Starts

- Only 25,000 square feet of industrial space is currently under construction in Burlington, far below the 10-year average of 510,000 square feet, signaling a slowdown in development. The under-construction property, located at 222 W Harden Street, is 25,000 sqft, with a completion date of February 2025.

Source: CoStar

Source: CoStar

Q4 Summary

- Rent Growth Above National Average: Market rents in Burlington have grown by 5.0% year-over-year in Q4 2024, outperforming the national average of 2.6%, but this is a decrease in growth from 2023.

- Vacancies: Industrial vacancies in Alamance County rose to 7.9% in Q4 2024 due to new project deliveries, while demand for smaller industrial and flex spaces remains strong amid limited supply. Despite slowing rent growth, asking rents in the region continue to outperform the national average.

- Economic Outlook: Nearshoring and onshoring continue influencing industrial growth in Alamance and the area continues to see major economic development announcements.

Sources: CoStar, Alamance Chamber of Commerce, Economic Development Partnerhsip of North Carolina